– ….coworking becoming less of a trend, more of a law

We hosted a webinar on 2, July 2021 around changes in the search, discovery, transaction (SDT) of CRE (commercial real estate) stock. Within this write-up, you can find some of the key takeaways from the seminar. The information density of the webinar prompted us to adopt a different format for this post-webinar note. Here, we take some of the most interesting statements made on the webinar, unpack them and their import, and add our own thinking to the same. There are a fair number of predictions in here, so buckle up! We try to write a predictions piece every year (check out our 2020 predictions piece here), this post-webinar piece doubles up as the same due to the sheer volume of predictions crammed in here.

Note 1: Edited for clarity, not a verbatim transcription.

Note 2: Flex and coworking are used interchangeably.

The webinar panel comprised of:

- Bhupindra Singh, MD – Regional Tenant Representation (India), Colliers

- Bhavin Thakker, MD – Mumbai Head – Cross Border Tenant Advisory, Savills

- Karan Singh Sodi, MD, JLL Mumbai & Director Board, Qdesq

- Anand Patil, Senior Director, Knight Frank, India

- Paras Arora, Founder & CEO, Qdesq

- Sumit Lakhani, Chief Marketing Officer, Awfis (Moderator)

Webinar recording:

Webinar insights & our predictions follow

On coworking absorption rates in the CRE market

What the panel said:

Pre 2017, there was around 32-34 million sq ft of uptake of CRE on an annual basis. Post 2017, this increased to around 42 mil sq ft of net absorption, with around 15% of this CRE being absorbed in the form of coworking spaces, which is a paradigm shift.

Our take:

15% of 42 million sq ft is around 6.3 million sq ft.

In other words, almost 80% of the increased demand for CRE resulted from coworking spaces.

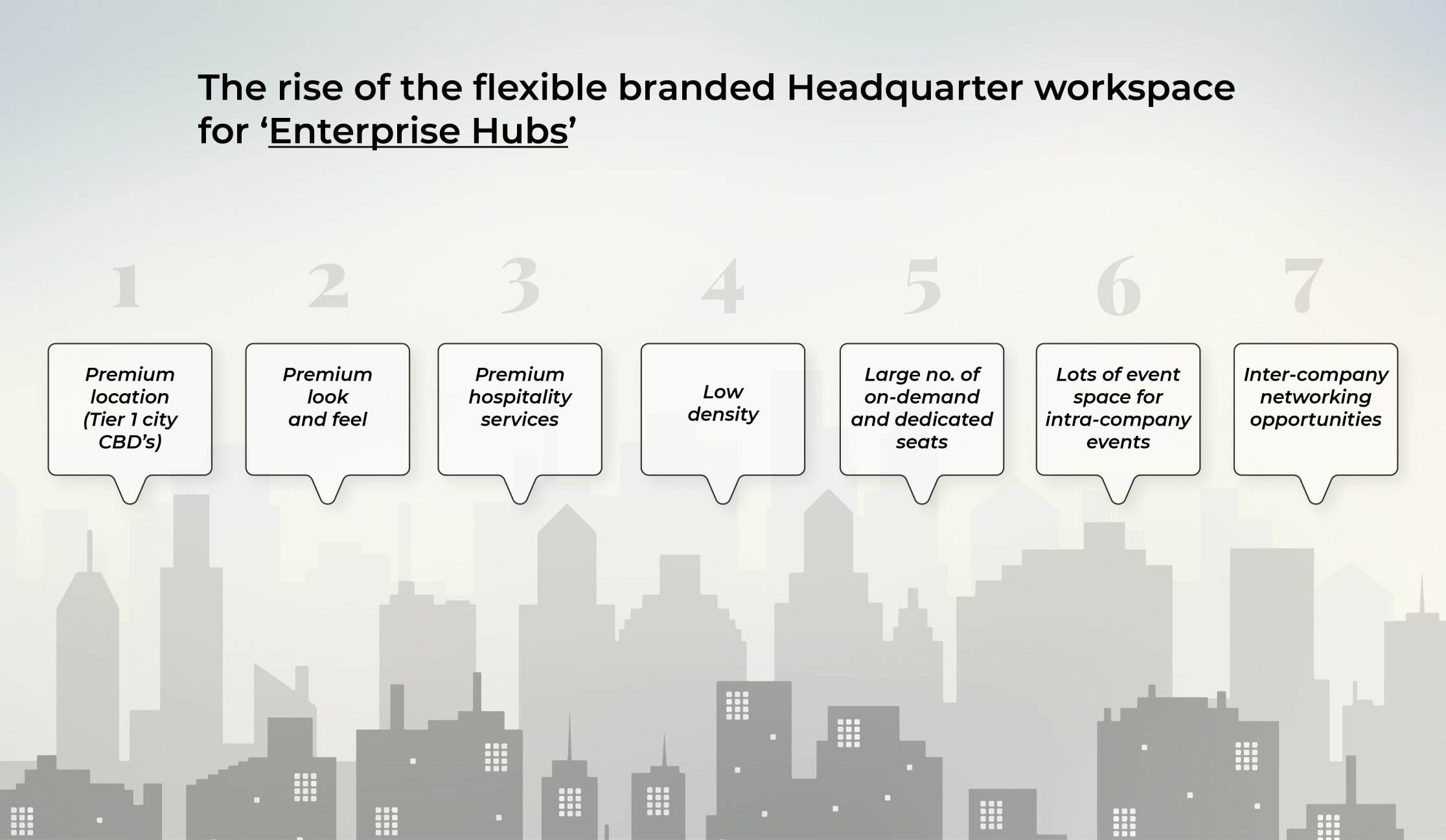

This dynamic will keep strengthening in favor of coworking spaces going forward, as coworking spaces eat into the market share of traditional CRE stock (read on for more on the future of this dynamic). The fall in demand for vanilla CRE leasing models will be further accelerated by the development of coworking spaces designed exclusively to serve as brand HQs. These will be designed to house senior leadership and will provide ample event hosting spaces and on-demand seating to enable employees from regional / city spokes to interact with their senior leadership.

Considering just fresh absorption, at 50 sq ft per desk, around 1.25 lakh coworking desks were added to the industry in 2018, in spite of strong incentives for developers and operators to fish for vanilla, long-term leases. From a developer perspective, locking in demand long term is more favorable than continually hunting for short term demand. However, changes to occupier expectations have forced such changes upon the supply side.

On the birth of coworking, growth in deal sizes, new deal types being demanded by enterprises

What the panel said:

Coworking started off in SBDs around 2010-12 to get new commercial buildings off the ground but has now gained widespread acceptance with coworking players moving to CBDs. It has grown from an average deal size of around 5-12 seats to over 70-100, with the range has increased to over 1000 seats in one deal.

There is an increasing number of instances of enterprises releasing multi-city requirements to manage 1000+ employees across multiple tier 1 and 2 cities in India. Demand for coworking spaces in India is set to jump to 130-140 million sq ft by 2025, accounting for 1/3rd of global coworking supply and demand.

Our take:

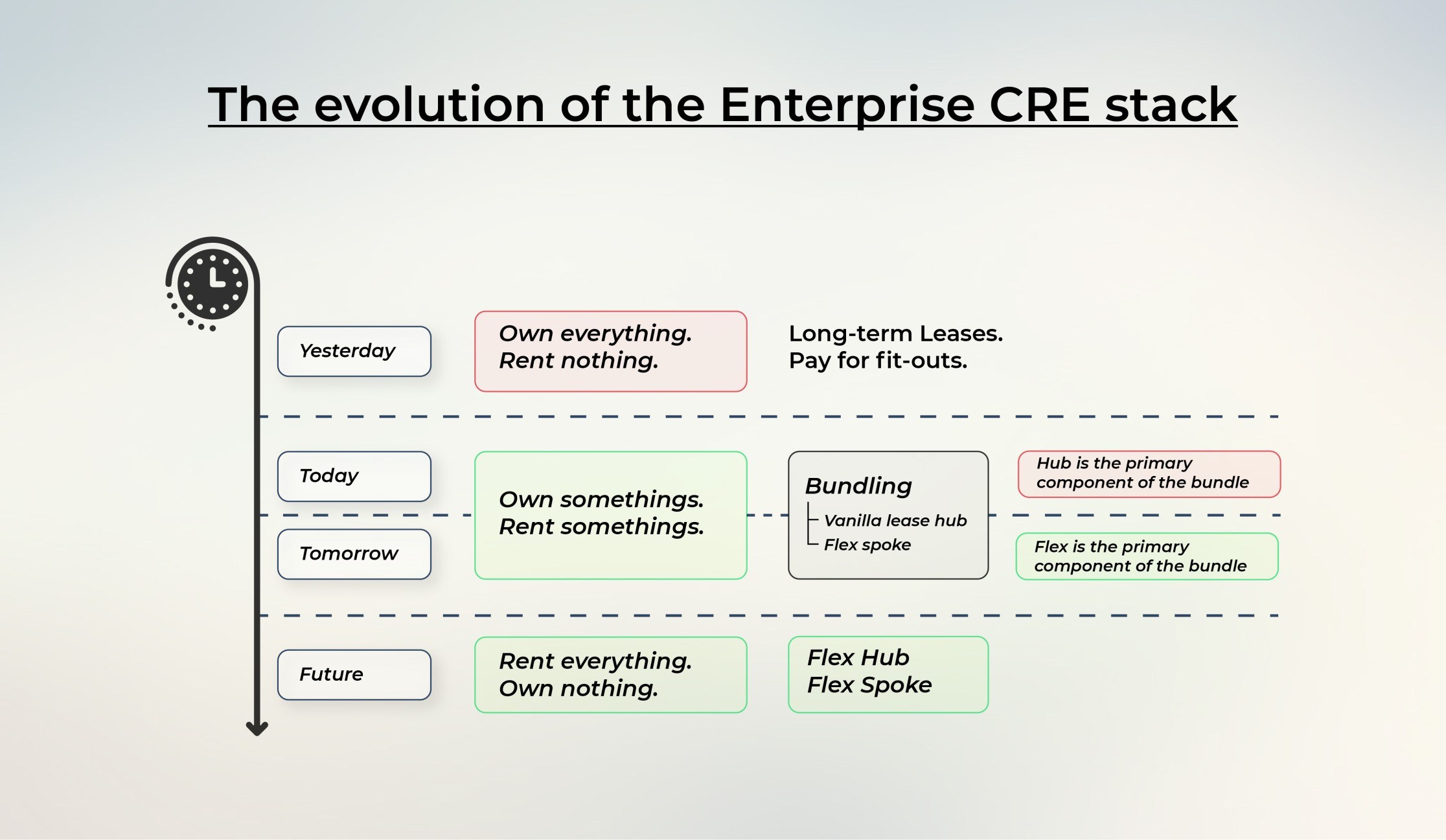

A bit of history, and then some crystal ball gazing. Pre-pandemic, coworking was a standalone segment but now is being bundled and sold with vanilla leases through the hub and spoke model to enterprises.

Bundling is a traditional means of helping a product gain wider mainstream acceptance, however, most bundles comprise complementary goods. This however is a unique case of substitute goods being bundled together.

What we envision happening going forward to this bundle is very interesting.

The CRE market started out with vanilla, long-term leases for enterprises. Then coworking emerged as an independent asset class. We are currently at the next phase of this evolutionary process, with coworking being bundled as an addon for enterprises. In a couple of years, we expect coworking to become the primary component of this CRE bundle. Eventually, we will be looking at just coworking spaces encompassing the entirety of the enterprise real estate portfolio, once brand HQ-focused premium coworking has taken off.

This is but the continuation of a decades-old trend where we started with corporates wanting to do everything themselves, but with time, have been parceling out more and more of the enterprise real estate management stack to third parties.

As a quick side note, a minor trend we expect to take off will be “Fitouts as a service”, wherein vendors provide the Capex for fitouts on a rental basis for enterprise hubs. Going forward, the mantra for companies seems to be simple. Rent everything, own nothing.

On coworking market share and evolution

What the panel said:

Estimates vary depending on how coworking gets defined and the sophistication of the estimation process, but coworking spaces currently account for anywhere from 3.5 to 9% of the total CRE stock in India, and the sector is expected to grow manifold to anywhere from 10 to 30% of the national stock within the next 3-4 years.

We’d like to see a little more innovation from coworking space operators in terms of diversifying out from the CBD sectors within the tier 1 cities going forward.

This will enable them to cater to unrealized demand in tier 2 and 3 cities and the SBD in tier 1 cities. Maybe, the hub-spoke model makes sense for operators themselves, with major centers in CBDs in tier 1 cities and spokes in SBDs in tier 1 cities and CBDs in tier 2 and 3 cities.

Our take:

What we find to be highly interesting here is that in spite of the variation in the current size of the coworking market, there is consensus around the growth rates for the sector.

All estimates tend to converge around a rough CAGR of 40% over the next 3 years assuming the total national CRE stock remains unchanged.

We will also come to witness an alignment between coworking space operator hubs and occupier hubs with the advent of the Brand / HQ coworking offices, a higher-end coworking space focused on C level staff with improved networking opportunities, a large number of on-demand seats, and large event spaces so companies can host events and workers from other coworking spaces / working from home who need to meet with senior management. The traditional office will slowly but inevitably and steadily lose market share, with enterprise hubs eventually based out of coworking spaces. Enterprise spokes will similarly map onto operator spokes, though the hub-hub mapping is still a couple of years away.

On the focus areas for coworking spaces going forward

What the panel said:

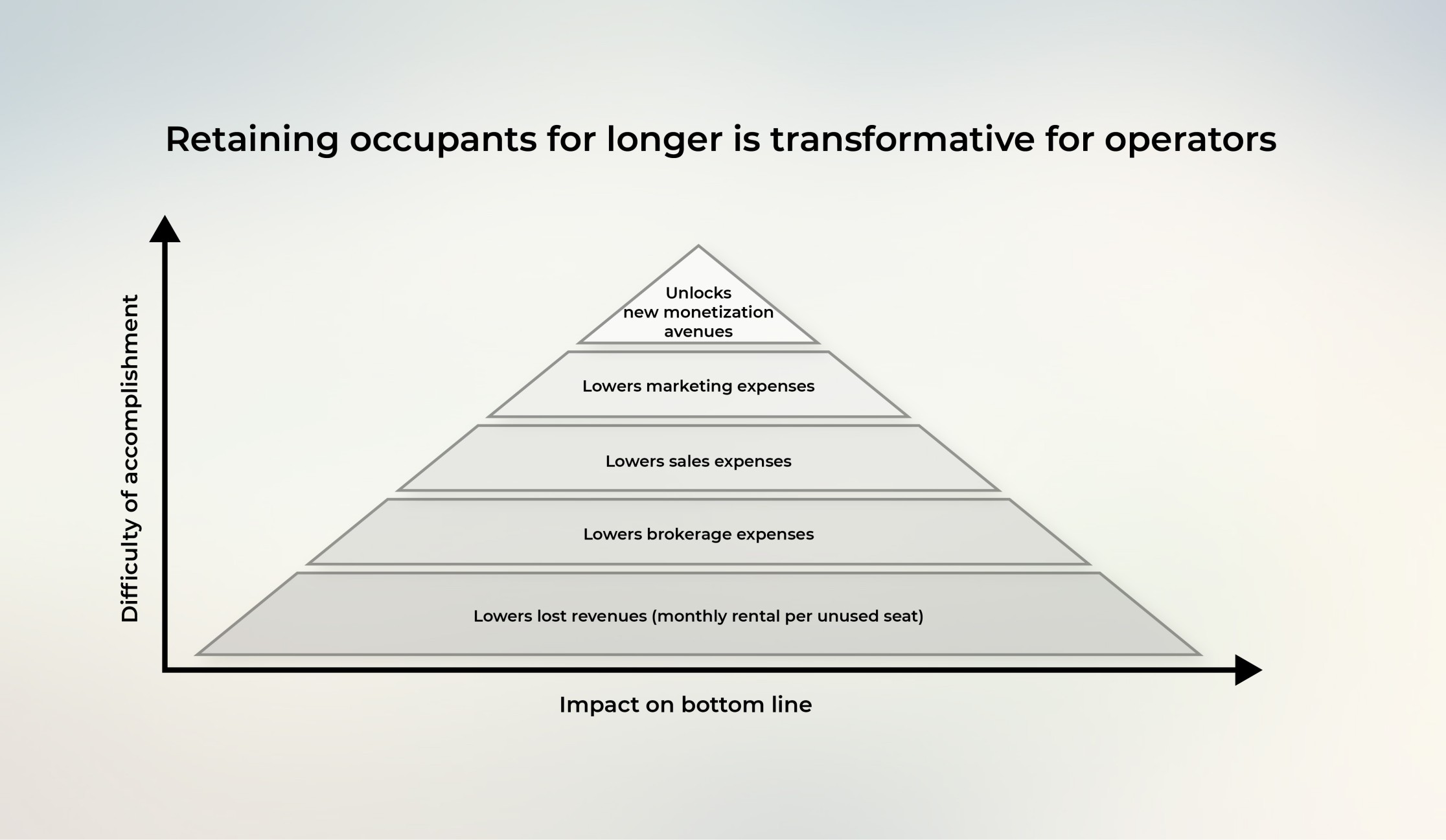

I think the industry needs to transition from getting the occupant to retaining the occupant

Our take:

We ran the math.

At even a 95% monthly customer retention rate, at the end of a year, a coworking space will have lost half of all its original occupier base. This will result in unsold inventory, high opportunity costs from lost revenues, and high sales, marketing, and brokerage expenses. All of which leads to lower revenues, lower margins, and the implication that it costs far far less to retain a customer than to acquire one.

Generating and converting a lead is the easy part but retaining one is the difficult yet far more profitable endeavour for a coworking space. Operators will increasingly standardize and digitize their internal customer-facing processes as a means of collecting customer experience (CX) and happiness data, improving their processes, and retaining occupants for longer. An improved CX will also enable operators to unlock new ways of monetizing their customer base

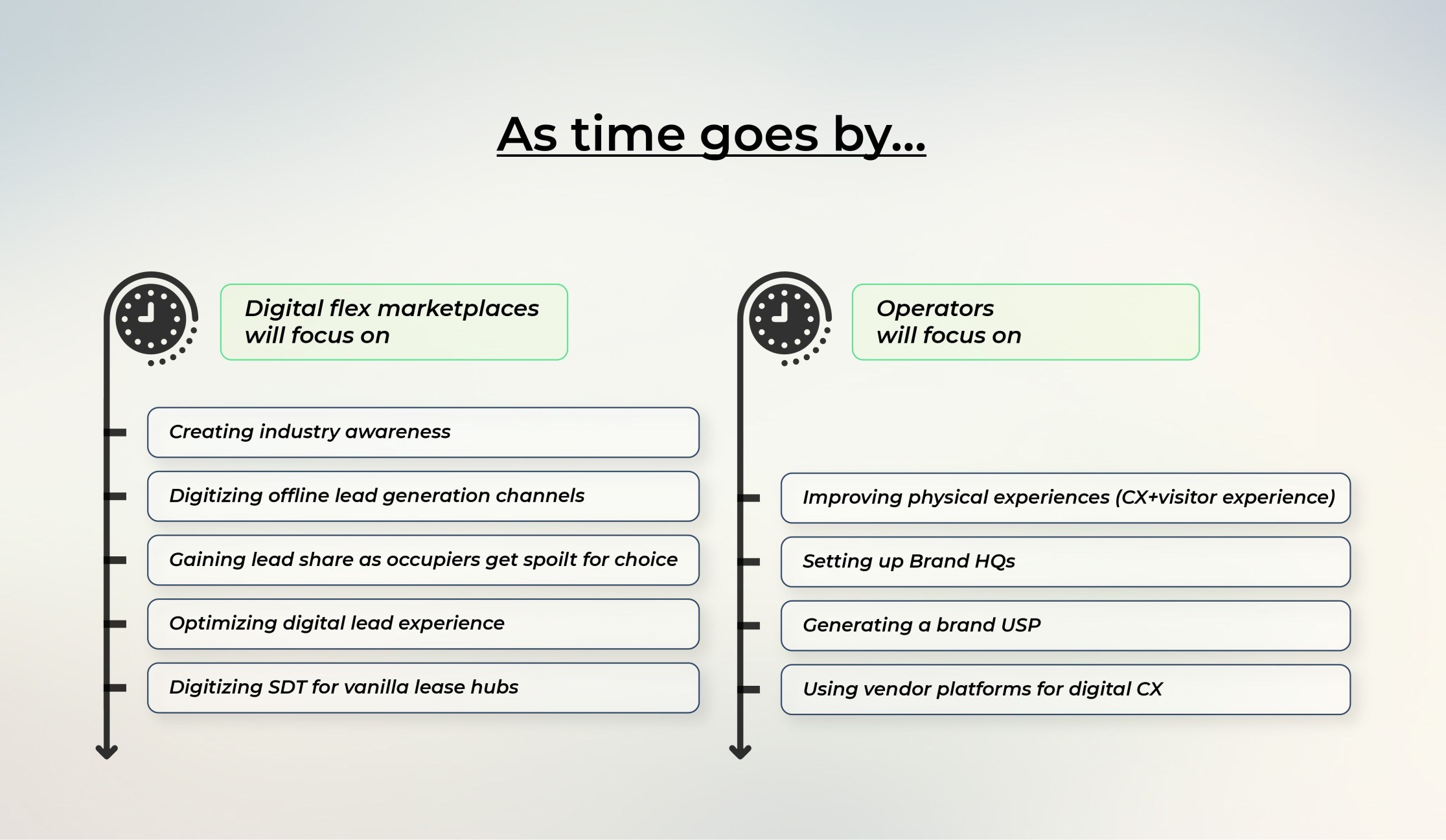

There will be a very clear delineation in terms of roles and responsibilities going forward. Operators currently are trying to do everything themselves at the expense of a focus on customer experience and retention.

We expect that with time, operators will focus on the physical experience of walkthroughs and customers while digital marketplaces will focus on the digital lead to customer experience.

More of the lead share will shift to digital marketplaces, similar to the revolution that took place with airlines and hotels, and that will soon take place for streaming digital content. Aggregators will control more and more of the search discovery transaction (SDT) process for the demand side with increasing awareness of the coworking product and increasing maturation of the supply side environment. Obviously, 100% of the customer experience will continue to be managed by the operator.

On coworking demand drivers for enterprises and employees

What the panel said:

86% of enterprise occupiers see a flexible workspace solution as a crucial part of their real estate portfolio management strategies, while 82% of the respondents from an AWFIS survey and 90% of the respondents from a Qdesq survey mentioned they were comfortable returning to the office as long as they have flexible work options

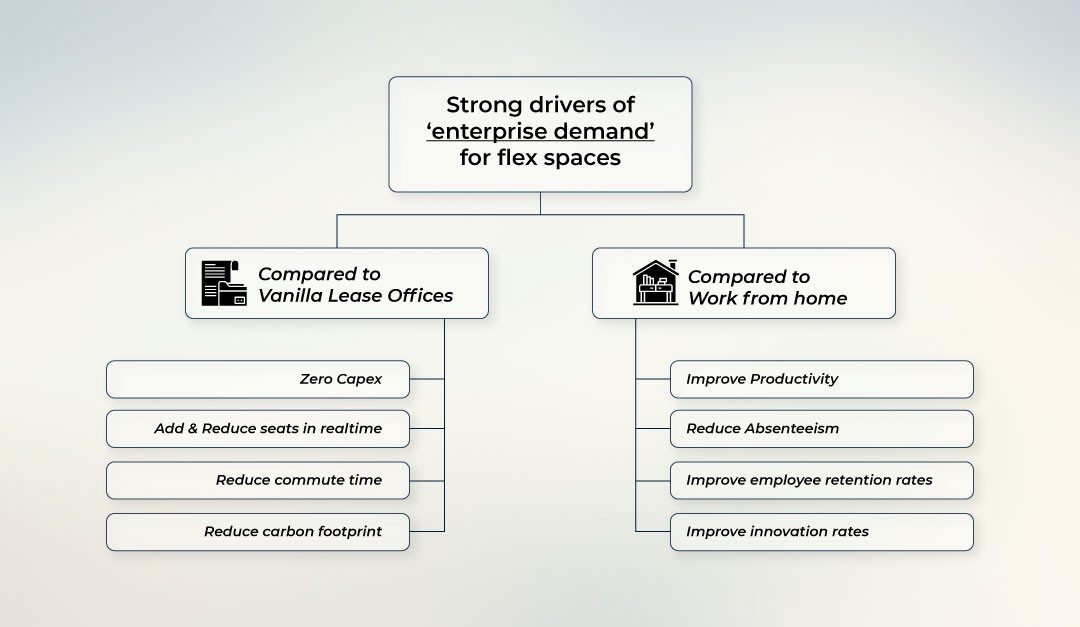

The drivers of these employee and employer sentiments are very clear. Adding increasing flexibility to work locations for employees (not just the office or just the home or a combination of the two) is positively correlated with reductions in absenteeism, improvements to productivity, and improved employee innovation and retention rates. The greater the flexibility of work locations offered to employees, the greater the value of the above-identified benefits accrued to the employer.

This is over and above the immediate branding & financial gains to an organization from a reduced carbon footprint, and the immediate financial gains from incurring zero Capex, being able to add and remove seats in real-time, and reduced workforce travel times.

For all of these reasons, almost no one wants to go back to the traditional office full-time or manage with just a mix of the office and the home.

Keeping these drivers of demand in mind, we are looking at a current average supply uptake rate of around 11% but we expect this to increase exponentially to around 30% within the next 2 years

Our take:

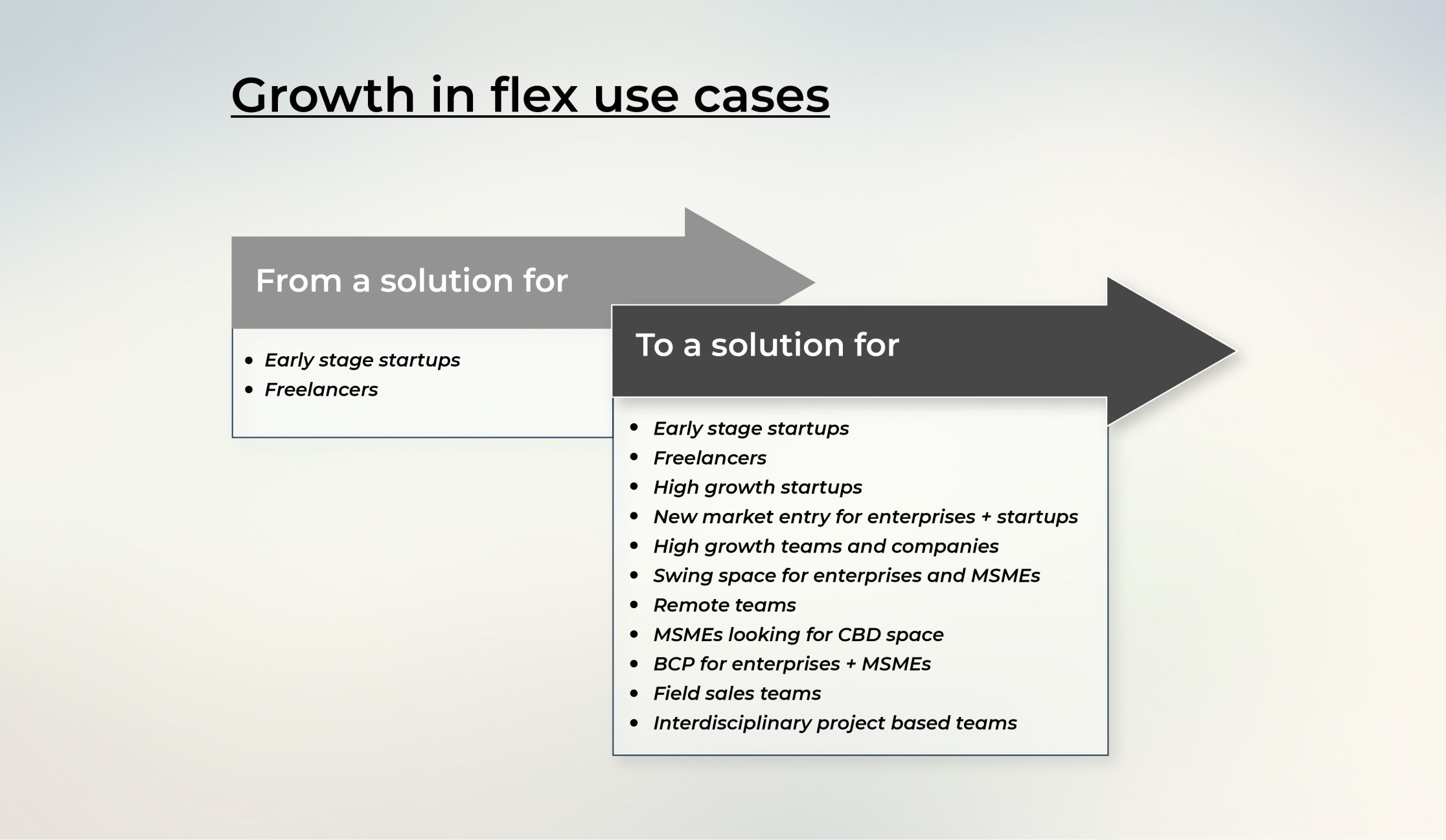

The number of use cases for coworking just keeps growing! What started out as an asset class for freelancers and then early-stage startups now caters to a myriad of use cases for freelancers, startups, MSMEs, and enterprises. Every need from BCP, new market entry, a solution for field sales / project-based / high innovation / remote teams, upsizing / downsizing, swing space can be catered to by the coworking space model. The strong demand for this product is a function of the rate at which the product has innovated to be able to cater to diverse, nuanced requirements from occupiers.

The next set of major innovations however will be on the supply side as supplier quality determination and differentiation improves, specialization of supply with a focus on particular use cases for specific target audiences takes place, and it becomes easier to set up spaces of different sizes and types (empty space anywhere getting monetized – restaurant, coffee shop, etc).

This will end up catering to a unique demand segment that is yet to be mainstreamed, hyperlocal hyper coworking.

The tech layer for SDT and for settling into a new workspace will get hyper optimized. Enterprise employees will have 3 products competing for their attention, the home, the office, and the coworking space. Digital SDT and digitally-enabled settling into a new coworking space, plus marketing to improve retail level awareness will be needed going forward to drive enterprise employee adoption. Until this happens, the enterprise employee will continue to favor the office or the home as the learning curve at a new coworking space for settling in and reaching optimal productivity and social integration when not digitally assisted can be prohibitively steep.

On coworking contributions to IPC revenue streams

What the panel said:

As a revenue stream for us, we expect this to be massive and it will only increase going forward.

We expect coworking to contribute around 20-30% of our (IPCs) revenues this year. We think this is less of a trend and more of a law.

Our take:

Touche!

A brokerage firm earns a one-time commission when it successfully matches demand with supply. Vanilla leases resulted in brokerages being earned once per deal for the duration of the lease.

Coworking and hyperflex will result in a larger number of individuals entering the market for office space (freelancers, startups, SMEs), with all demand segments including enterprise employees requiring matching services multiple times a year as they take advantage of easy exits to change the view at a regular cadence.

Coworking will account for an ever-increasing proportion of the revenue accruing to IPCs, marketplaces, etc.

IPCs will continue to serve as the broker of choice for marquee clients for some time due to their existing relationships with the IPCs and since enterprises will place more of a focus on optimizing their vanilla offices and will view spokes from more of an experimentation mindset.

By the time the market has shifted towards offering coworking as the primary component of the CRE bundle offered to enterprises, coworking marketplaces would have begun offering integrated hub-spoke solutions by having built capabilities around the digital SDT of vanilla office spaces.

At this point in time, the market will realign around digital coworking marketplaces as the primary lead source of choice for enterprises.

On the transition toward a majoritarian coworking CRE market being aided by reverse leasing of conventionally leased office space

What the panel said:

Reverse leasing is very much the need of the hour

Our take:

Reverse leasing within the CRE sector typically comprises a stressed corporation looking to offload its real estate assets in exchange for a lease that provides the corporation the right to continue monetizing the land as desired. Proceeds from the sale fund investment in new opportunities or in revitalizing / strengthening the core business, and core business operations fund the monthly rentals for the land that was offloaded.

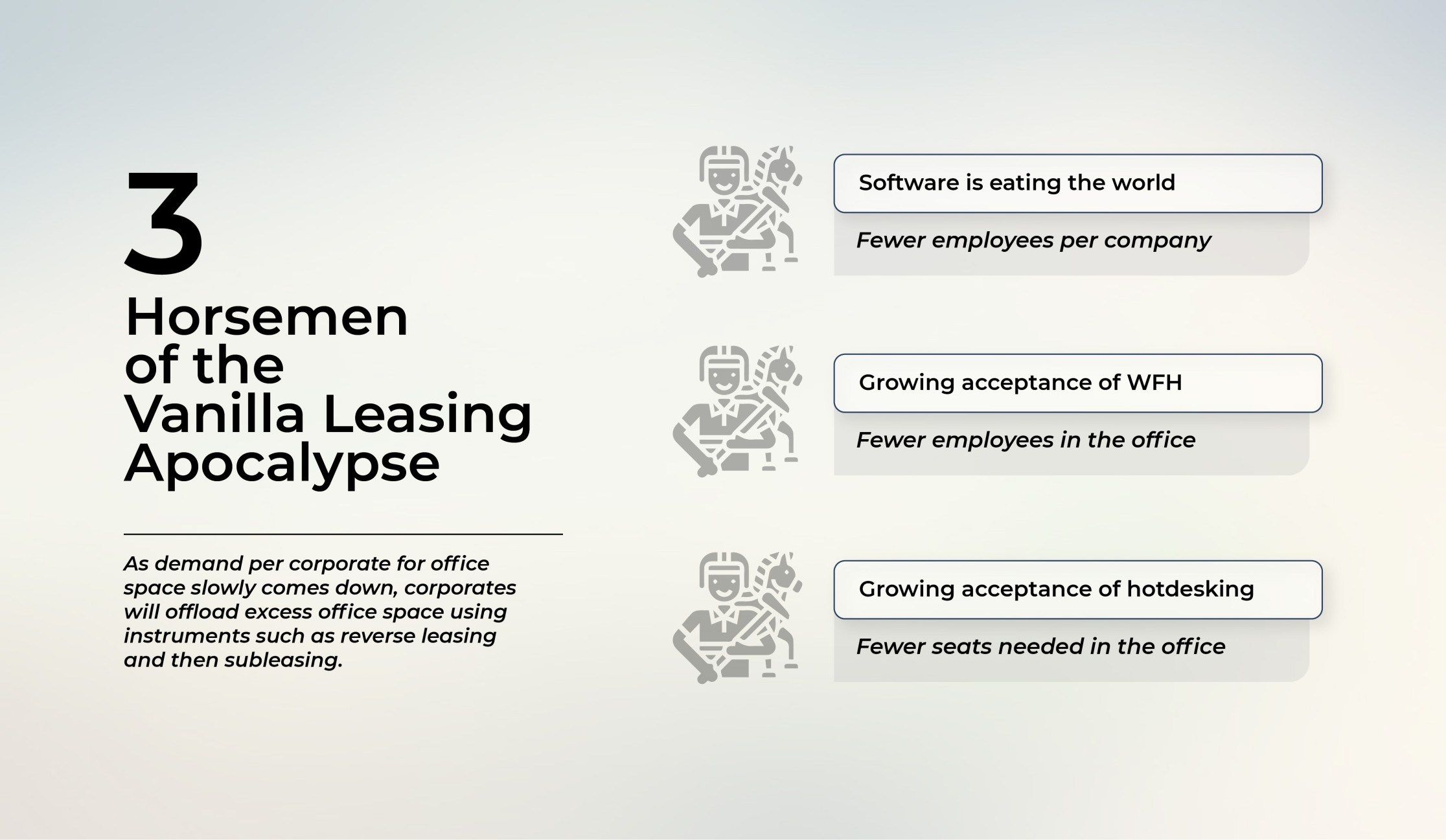

There are three major developing trends that we tend to refer to as the 3 horsemen of the Vanilla Leasing Real Estate Apocalypse.

- Software is eating the world. Increasing process automation and digitization of distribution channels means fewer and fewer people per company, in every function, every year.

- Growing acceptance of WFH meaning fewer sq feet per company office.

- Growing acceptance of hot-desking since the nature of work done from office is changing meaning fewer sq feet per company office

These trends will strengthen with time, resulting in many corporations realizing they are saddled with more real estate than necessitated by their operations. However, when you have millions of dollars sunk into office space and hundreds/thousands of individuals employed by your internal real estate management teams, your internal CRE lobby will try to find ways to maintain these assets on the books in order to justify its own existence.

Which is where reverse leasing comes up as a stopgap measure that enables corporations to monetize unused space better to fund core business ops while maintaining the existence of such internal lobbies.

Next on the pathway to the complete disposal of corporate CRE assets is subleasing, where the corporation leases the land out to a third party and begins to downsize its CRE investment + management teams over the duration of the sublease, with minimal scope for renewal of the sublease, completing the exit of the corporate from the business of owning, maintaining and managing any CRE at all.

In our view, the use of these instruments is still a couple of years away largely because while coworking has received enthusiastic backing at the enterprise level, we are yet to witness the wholesale adoption of coworking by employees. Employees will take time to experiment with the combination of WFH, WFO, WFA, adjust, and prove to corporations that a hybrid workforce management strategy is essential for optimizing productivity.

Only when this event takes place (wholesale + successful adoption by employees) will we begin to hear calls within corporations for the sale of CRE assets which will trigger this cycle of reverse leasing, sub-leasing, and the diminution of the internal CRE management teams.

Of course, this is not to say that the industry won’t identify additional reverse leasing models, such as say a reverse lease between the stressed developer + cash-rich operator, or between the stressed developer + cash-rich occupier. However, we will treat these additional models in an upcoming piece on the industry and its future.