Occupant demand for Flex offices has risen substantially in the last two years. CRE heads and Business leadership are re-assessing the role of workspace in Business growth and performance, resulting in trends towards flexibility, “Hybrid” and decentralized offices.

Keeping up with the customary and ritual of writing my piece on flex trends of the year. Following seems to be taking substantive mindshare.

– Paras Arora

Founder & CEO, Qdesq

- CRE strategy

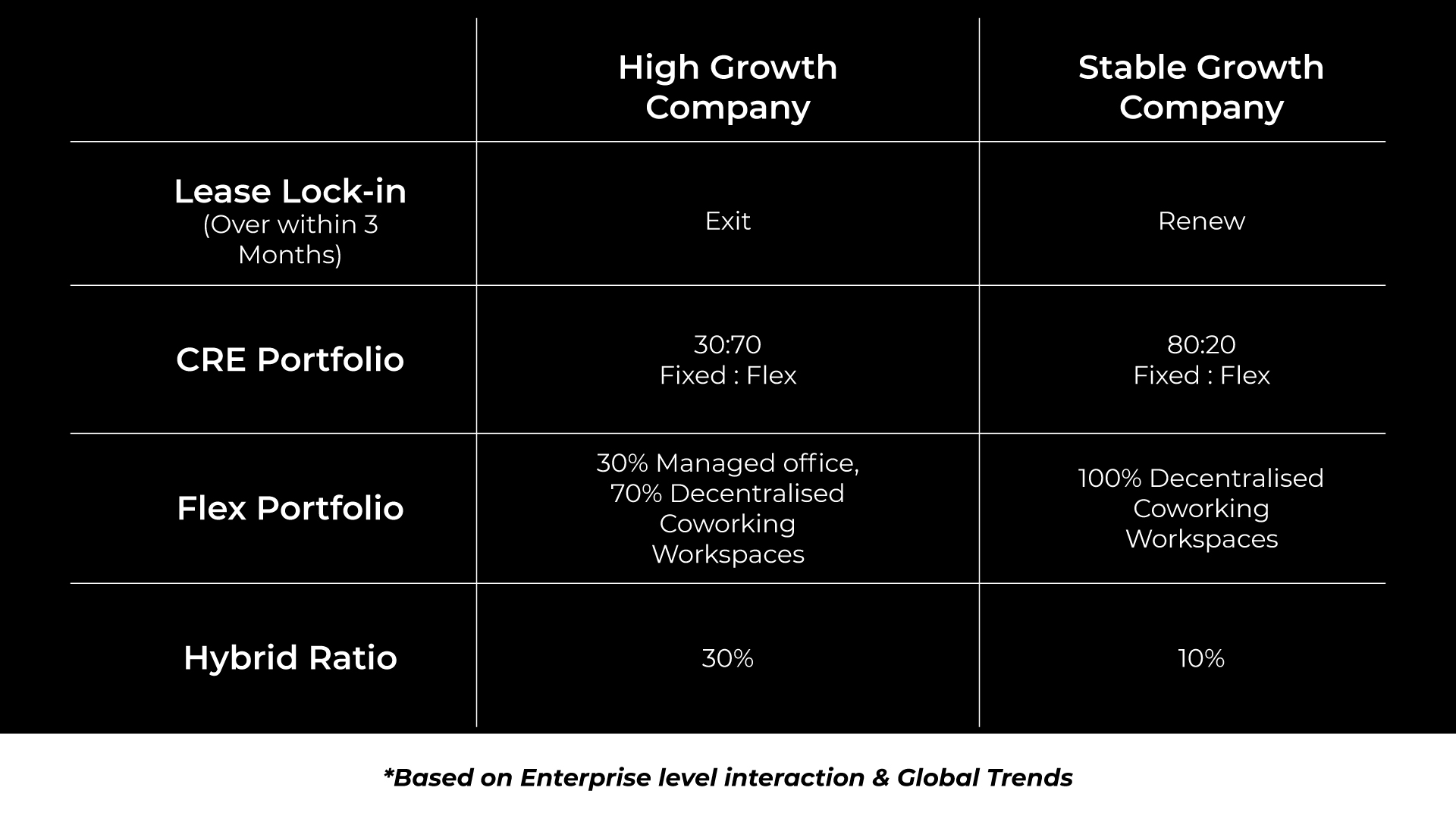

CRE Strategy is in for evolution. COVID and ability/inability to work from home in relation to business requirements leading to strategic decision making and remodeling. A basic Quadrant Analysis on this is as follows:

- Decentralised Offices

This phenomenon is an absolute CRE disruption to the one-office strategy that pre-COVID every enterprise used to follow. The importance of commute time and optimization of space at HQ level coupled with the ability to acquire coworking offices faster across the country propels this movement.

This is a classic Hub and Spoke model with one HQ and multiple offices intra city or intercity. Large corporations with stable growth are the major adopters of it.

- Health and wellness is the top priority

According to a recent McKinsey report,

“the top drivers of those who have encountered negative psychological impacts of trying to return on-site have been concerned about…COVID-19.” These include concerns about the employee’s own “safety due to COVID-19 (45%) and the risk of contracting the virus and transmitting it to unvaccinated or at-risk children and loved ones (29%).”

Adopting a hub-and-spoke or other hybrid workplace model that most coworking spaces function as satellite offices could not only decrease employee fear of the COVID-19 but also protect businesses from monetary loss.

- Significance of Quality and differentiation

Flexible workspace operators are pushing for their design standards more than ever before, owing to occupiers’ strong desire to supply their employees with the best workplace environment possible. It is not just location and pricing. The look and feel, services, expandability, and key drivers in the workspace selection.

- Automation to enhance experience & productivity

The goal of the innovation is not to overwhelm occupants and managers but rather to massively improve and streamline their workspace experience.

Occupants of flex spaces expect easy and important tech from the operators, and they don’t want to be swamped with apps having unnecessary tech overload. They want to be able to book workstations & meeting rooms and key variables to have a seamless occupancy experience.

- Landlords in the Game

Many landlords are converting their properties into flexible workspaces and managed offices. The resilience and adaptation by landlords to add hospitality to the assets are appreciated. Having said that, willingness is still to give on lease to an operator.

- Conventional Vs. Flex

Finally, always the big question.

In qualitative evaluation, conventional makes prudent sense:

-

-

- When conventional is in oversupply, making it extremely affordable.

- When the requirement is 200+ pax with clear and fixed visibility on growth and headcount for at least 24-36 months.

-

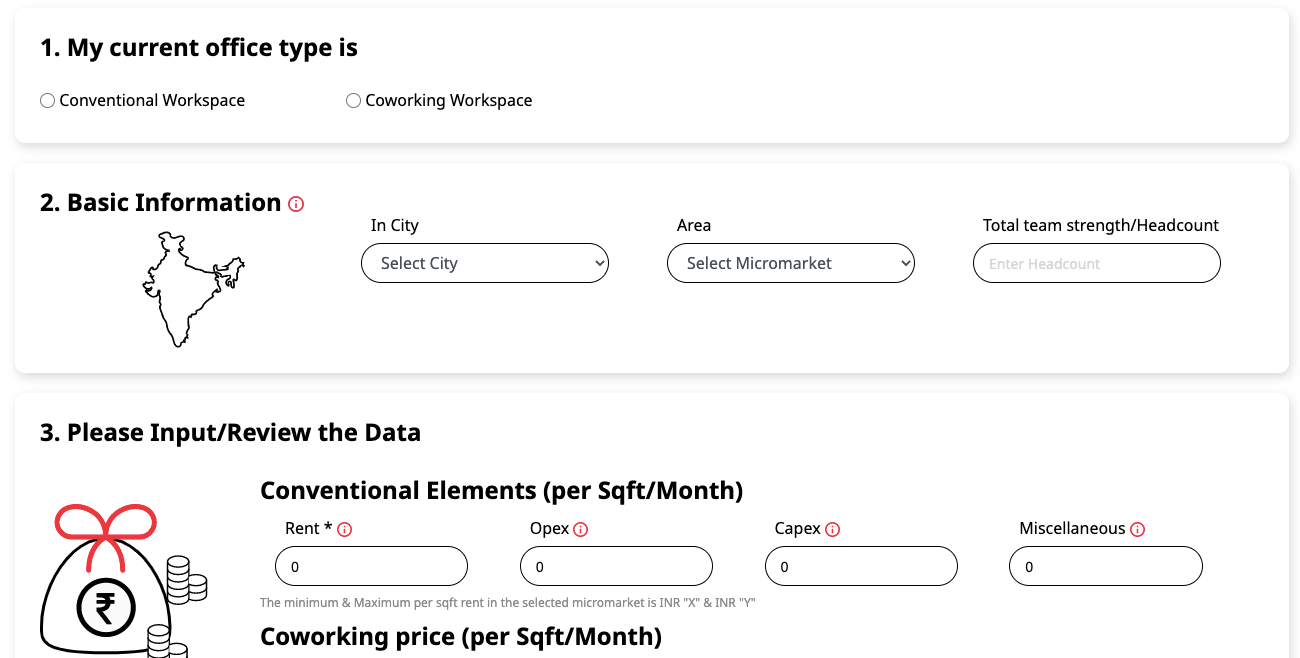

In Quantitative evaluation, for the key micro markets, we have been using CalQ for benchmarking and Capex amortization

To sum up

The expected trends will change the outlook of the commercial real-estate industry where people would prefer functionality over traditional approaches.