2021 will prove to be a red-letter year for the coworking industry. As the dust slowly settles around the coronavirus pandemic and clarity emerges on how Indians will continue to work post our exit from this black swan event, here are a couple of trends that have emerged or accelerated over this year that will define the industry in 2021.

- Shrinking demand for traditional leases:

Long term office leases have been the go-to solution for enterprises for decades since they come with lower per sq ft costs and a sense of complete ownership of an office space. Enterprises were happy to adopt such solutions inspite of the downsides of the same (being locked into fixed long-term rentals, higher per seat cost, paying upfront for seats you may / may not need in the future) because they were operating in relatively stable markets.

However, as global markets and supply chains get more integrated, they also become more sensitive and complex. In an increasingly complex environment, small changes in global market and supply chain conditions can drive severe downstream business cycle fluctuations (the butterfly effect), forcing enterprises to value coworkingibility and agility in their cost structures. This broader trend has been reinforced by the pandemic that has shuttered enterprises and regional branches that were unable to renegotiate their fixed office rental payments.

The second factor driving a decrease in this demand is the rise of the digital economy. The user base for most tech products follows a Pareto distribution (80% of your user base is lightly engaged by your product), which implies that all but your power users face low switching costs. The digital economy consumer is a notoriously fickle citizen.

Incremental innovation + ad dollars by competitors can easily attract a majority of your user base. Which means. Today you have a 100 million users. Tomorrow, you have lost half your flock. For tech products, any David can become a Goliath overnight and vice versa.

In the face of this exponentially higher variability in the competitive landscape, it again makes sense for tech companies to align their cost structures around the principles of flexibility and agility.

Small wonder then that we are witnessing a chilling effect on the demand for long term leases and lock-ins. Enterprises have started ditching traditional workspace solutions en masse. What used to be a trickle has turned into a deluge of exits by MNC’s and enterprises, for teams across functions and for both the execution and management layers of their workforce. We expect this trend to accelerate with time.

- The development of new workforce distribution models and the meteoric rise of WNH (work near home):

In addition to the factors pushing enterprise demand away from traditionally leased offices, there are multiple pull factors that make the coworking space product attractive to enterprises.

Converting fixed rental payments into variable costs that increase or decrease in realtime as a function of the labor strength of the company are obviously a key pull factor, and were always a part of the core value proposition for the product.

However, coworking spaces also offer enterprises the ability to create a flexible commercial real estate portfolio strategy that matches the needs of their business and the spatial and functional distribution of their employees. Let:

-

-

- Field sales staff check into coworking spaces whenever they wish to, across every city in the country, using one national access pass.

- Employees use a mix of work from home and work near home strategies to maximize productivity.

- Teams working on interdisciplinary, complex, time sensitive projects use coworking spaces for more effective face-2-face meetings.

- Senior staff hobnob with other C level executives at coworking spaces dedicated to hosting C staff, and then disseminate inter-industry best practices within their company.

- Smaller regional teams work from more cost-effective coworking spaces while the head office operates out of a traditionally leased facility.

- Tech companies with large head offices and non-existent regional offices use coworking spaces for spokes co-located with the hub in the same city, to minimize travel times and carbon emissions for employees.

-

As a national marketplace for coworking spaces, or “work near home” solutions, we had been observing increasing experimentation by enterprise players with the coworking space product but of late, we have witnessed a wholehearted adoption of the product by Indian and international MNC’s. The Covid pandemic has acted as an accelerant for the coworking space industry, forcing the distillation of years of careful experimentation and adoption by enterprises into a half a year.

- Razor sharp focus on optimizing the coworking occupant experience and retaining occupants:

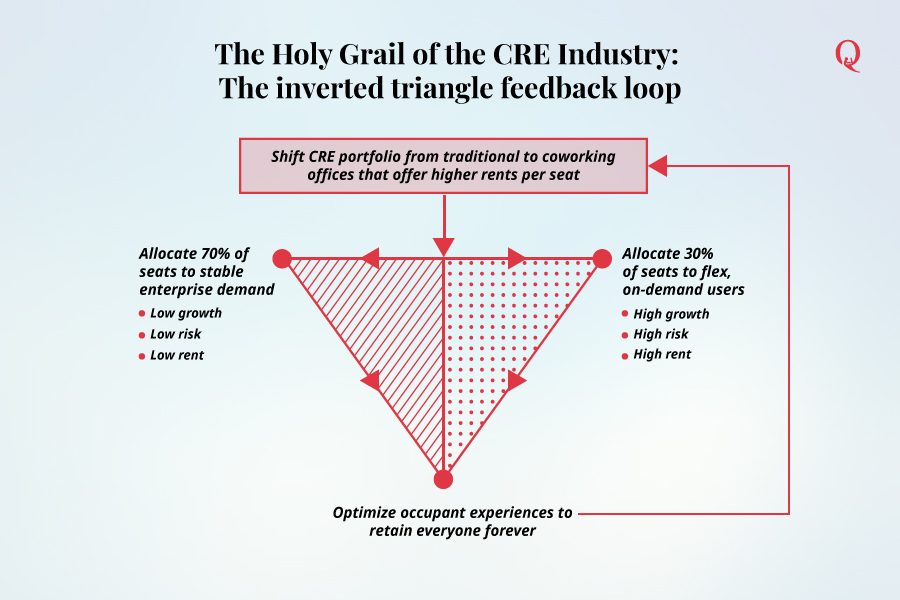

What is the holy grail for the CRE industry? How does one go about optimizing their returns from a commercial real estate portfolio?

-

-

- Brand commercial, traditionally leased space as a coworking workspace that earns you more per seat per month.

- Then, through the right branding and digital visibility, attract enterprise demand that takes up a large proportion of your seats. Enterprises form the base component of your demand since they have a relatively low turnover rate.

- Bid out your remaining seats to hot deskers and other forms of fractional demand, at even higher rates per hour, day, week.

- Use occupant experience management software that is focused on maximizing customer retention rates to optimize your occupancy levels.

-

Voila. Holy grail achieved.

Coworking spaces naturally offer higher earnings and margins for coworking operators versus traditionally leased offices. With the recent pandemic, not only has enterprise demand taken off, but operators have also found a renewed focus on optimizing the occupant experience in a bid to improve profitability and stay afloat. We expect this focus on occupant experiences to persist long after the pandemic is over because coworking space operators would have realized that every occupant retained incrementally for every additional month means lower selling, marketing expenses, higher revenues, improved profitability, and a healthier, vibrant community.

- Proportion of CRE stock repurposed for coworking at its highest level ever:

CRE stock repurposing rates have hit an all time peak recently because traditional leases have been cancelled invoking force majeure clauses and this idle CRE stock is now being repurposed for coworking use since demand for traditional leases has evaporated and is likely to stay deflated. Given the revolutionary nature of the coworking space product, we believe that this is unlikely to be a temporary fillip to the volume of coworking stock being injected into the ecosystem month on month.

- Coworking space providers will find new ways to differentiate their offerings:

The current search + discovery process for coworking workspaces comprises of searching basis location and price. However, the addition of exponentially more stock year on year will force coworking space operators to start differentiating themselves in more unique ways as they all compete to rank high for mindshare and digital discoverability. Think filters enabling the demand side to discover workspaces that are

-

-

- Women friendly, environment friendly, have engaged communities etc.

- Focused on providing office space for specific stages of the company lifecycle. 0 to 1. Then 1 to 100. Then steady state management.

- Focused on seniority levels. Workspaces exclusively for senior management. And others focused on mid plus junior management and the execution layers. A club, to which your business card, position, & function is your entry ticket.

-

Also think highly credible filters that accurately reflect the reality of working out of a workspace, i.e. filters generated on the basis of occupant feedback, not self styled descriptions of workspaces by owners of such workspaces that your lead traffic is exponentially less likely to find credible.

We expect the development of such differentiation to enable better matching of digital search traffic with workspaces, resulting in reduced conversion times for leads and better conversion ratios for workspaces. Our hunch is that the offering of a less homogenized product will start taking place sometime over the next 2-3 years.

- Coworking workspace differentiation is the only way to enhance consumer price insensitivity and “unbundle” the CBD:

As providers develop their unique selling propositions (USP’s), and start offering a non-commodified product in the market, they will start competing on the basis of value and USP’s instead of just pricing + location. This will also enable them to move away from discount led sales and realize pricing gains of 25-50% on a per seat basis, increasing the average price per seat for the industry, uplifting its profitability, and again accelerating supply addition rates.

This will also lead to what we call the “grand unbundling” of the central business district (CBD) of a city. Most coworking spaces tend to be co-located within the CBD, since they can only compete on the basis of location and price and they will lose out on demand if they aren’t present in the right location. This results in:

-

-

- A concentration of coworking spaces within the CBD

- Rents paid to landlords rise since there is restricted supply of commercial stock in the CBD and demand from coworking space operators is accelerating as such operators face limited choices when it comes to locations

- Revenues per seat tend to fall as there is a glut of choices for seekers of coworking spaces who proceed to play one operator off against the other for a better deal

-

We’ve seen this dynamic play out in city after city, and reduce the profitability of coworking spaces as a whole.

How do we break this vicious cycle? By enabling coworking spaces to compete for seekers on the basis of occupant generated, credible USP’s that allow you to set up quirky coworking spaces in unique locations, pay reasonable rents to landlords, seek reasonable revenues from seekers, maximize demand and profitability for your space.

Disclaimer 1: Views expressed are of the author and reflect their personal sentiment on the subject matter.

Disclaimer 2:This is a lengthier, more explanatory version of an article that was published in Forbes.